The PDC is aware of an issue that is causing data on its website to load slowly. We have alerted the state’s Open Data vendor and are urging it to find the root cause. In the meantime, trying hitting the refresh button, or wait a few moments before trying your data query again.

Lobbyists and their employers, also sometimes referred to as clients, submit employment contracts to the Public Disclosure Commission reporting the scope of their employment. If a lobbyist works for an employer during at least one month of a calendar year, the employer is required to file an L-3, for that year.

See the instructions below to file an L-3 using the PDC’s new electronic filing system.

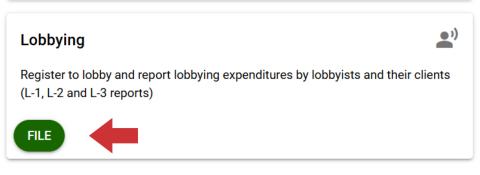

- 1. First, log into the PDC’s electronic reporting system. Click “File” on the Lobbying tile.

-

Image

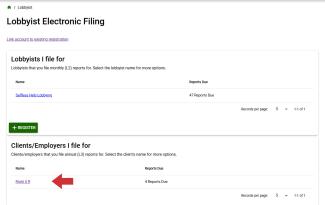

- 2. Select the employer’s name under “Clients/Employers I file for.”

-

Image

The following screen includes a section for Annual Reports (L-3). File an annual report for a year after the lobbyist has filed all of their monthly reports for that year. Click “Start” to begin.

- 3. Compensation and Expenses

-

Compensation: This section shows the amount incurred (what was paid and may be owing) during the year for lobbying-related compensation. This includes any funds set aside for deferred income, bonuses or the value of similar deferred payments paid or due.

Enter the amount of compensation paid and due for services proved by the lobbyist during that year in the Actual Compensation field. Click “Use lobbyist reported compensation” to make all fields match the amount that the lobbyists reported on their monthly reports, if that is accurate.

At any point, you may select “Finish Later” to save your work for later.

Image

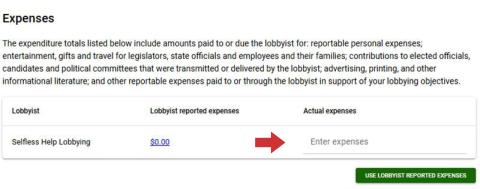

Expenses: This field shows the sum of the amounts paid to or due to the lobbyist for items such as: reportable personal expenses; entertainment, gifts and travel for legislators, state officials and employees and their families; contributions to elected officials, candidates and political committees that were transmitted or delivered by the lobbyist; advertising, printing, and other informational literature; and other reportable expenses paid to or through the lobbyist in support of your lobbying objectives.

This is the total of what the lobbyists reported on their monthly reports. Enter the amount of expenses for that year in the “Actual Expenses” field. Select “Use lobbyist reported expenses” to make all fields match the amount that the lobbyists reported on their monthly reports, if that is accurate.

Click “Next” after each step to move on.

Image

- 4. Election expenses

-

Image

Answer all of the yes-or-no questions in this window. Enter the total of all political contributions of $100 or less that the employer made during the reporting year that were not reported by the lobbyist. Enter a zero in this field if the correct amount is $0.

If you answered “yes” to any of the above sections, clicking the “Next” button will bring up a window for each of those questions. Fill out each window.

If you need to make more than one entry, click the plus sign. If you indicated “yes” in error for a question, you may change it to “no” here. If you entered information into the window, then change it to “no,” the system will confirm if you would like to clear the data that you have entered for this question.

- 5. Lobbying expenses

-

In this field, report lobbying-related expenses that have not been reported by the lobbyist.

First, answer three yes-or-no questions related to expenditures associated with state officials, related to gifts, items such as speakers’ fees, and other reportable lobbying expenditures.Then report the amount expended for direct lobbying, including payments to vendors in support of lobbyists, a total amount spent for expert witnesses or other lobbying services, and total expenditures for the creation and distribution of promotional materials.

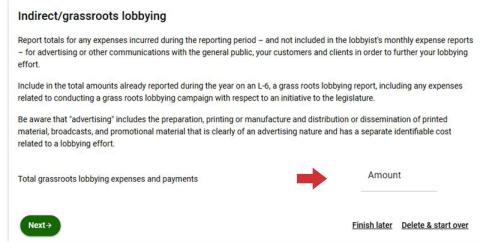

Indirect/grassroots lobbying

This kind of lobbying is addressed to the general public, a substantial portion of which is intended, designed or calculated primarily to influence state legislation.

On the lobbying expenses window of the L3, the filer must enter an amount for total grassroots lobbying expenses and payments before they may use the “Next” button. This amount may be zero.Image

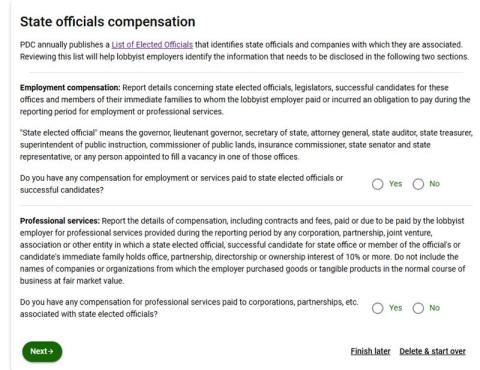

- 6. State officials' compensation

-

Report details concerning statewide elected officials, legislators, successful candidates and members of their immediate families to whom the lobbyist employer paid or incurred an obligation to pay during the reporting period for employment or professional services.

Report compensation for professional services paid by the employer, in some circumstances. If you answer “yes” to either question, the employer may need to file PDC form L-7. Please see this page for more information.

Image

- 7. Review

-

If you left any field blank or made any other error that the system detected, it will be listed there. Click the “Fix It” button to return to that section and make corrections. Select “Review” in the column on the right to go back to the review section.

When the review section says, “we have no problems with your report,” select Preview and Submit. The preview window will show the completed form. You can still make changes with the “Edit” button.

If your report is finished, submit it. Follow the instructions to certify the report, then select “Submit” again.